Deepr.fun

The Evolution of Fair Token Launches

The Problem

Current token launches are broken:

- Entire supply can be bundled at launch by whales

- Sophisticated actors often gain unfair advantages, acquiring significant portions of supply before others can participate.

- Price crashes on small sells due to poor liquidity

- High initial liquidity requirements price out most projects

⚠️

Real-world evidence from Pump.fun:

- Total coins bonded: 87,170

- Only 4 coins reached >$100m market cap (0.005%)

- Only 40 coins reached >$10m market cap (0.05%)

- Only 250 coins reached >$1m market cap (0.3%)

- 79,000 coins (90.6%) ended with <$100k market cap = indicative of systemic issues leading to rugs [].

The Solution

Deepr.fun revolutionizes token launches with:

The Platform

- Full-featured token deployer now live on Base

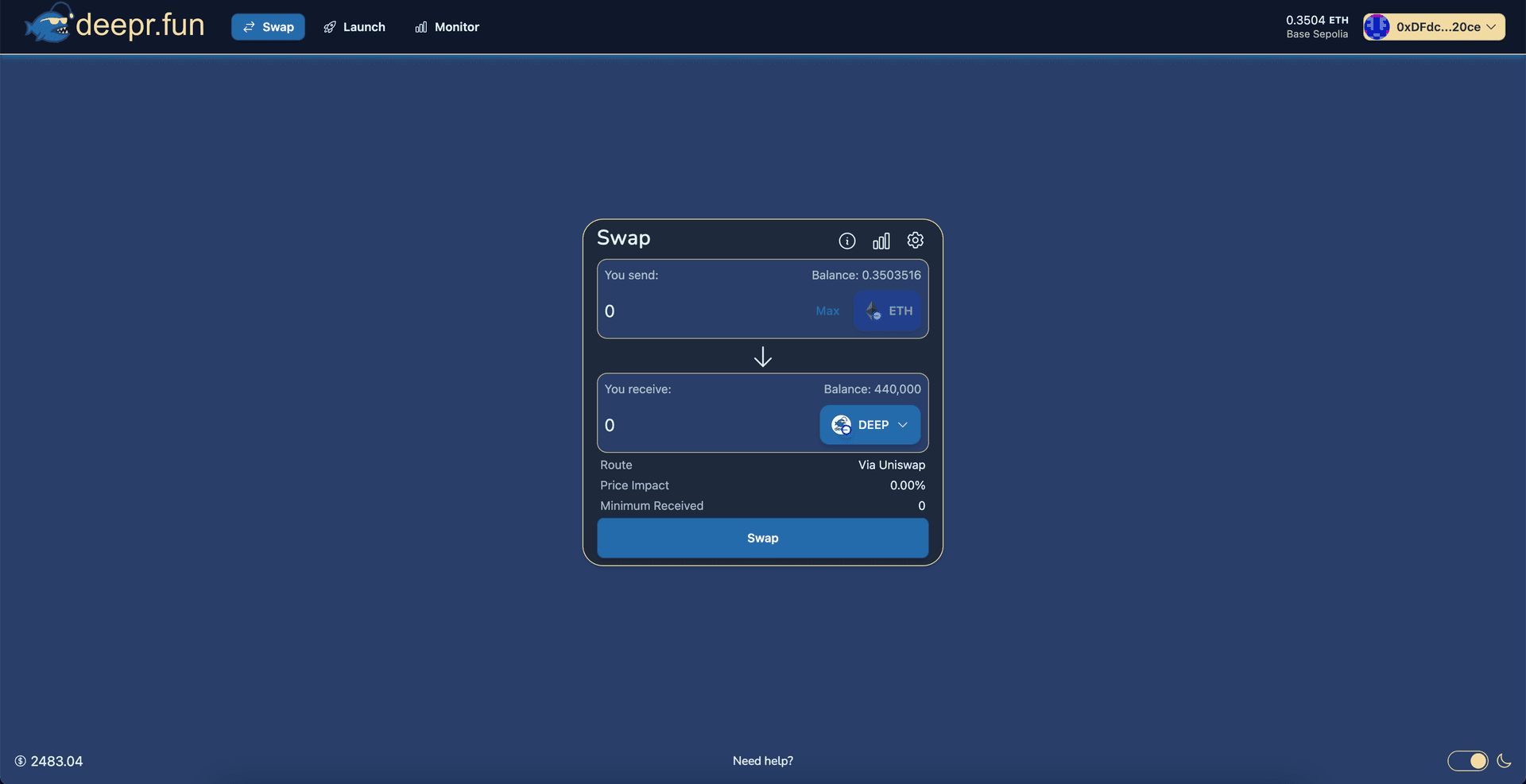

- Built-in swap interface routes to the best price (uniswap vs tranche)

- Enhanced progressive liquidity system

- Native

$DEEPRtoken deployed at

Deepr.fun swap interface - Token Exchange

Deepr.fun swap interface - Advanced Settings

The Token

- Launched: The

$DEEPRtoken has completed its TGE and is live at - Fee Structure: When liquidity is added (initial deployment & tranche buys 1-13), a 10% fee is applied to both the ETH and Tokens being paired:

- ETH Fee (10%): 75% is sent to the project deployer, 25% to the Deepr Vault.

- Token Fee (10% of LP tokens = 5% of total tranche tokens): 100% is sent to the Deepr Airdrop address.

- Holders of the native Deepr token receive rewards sourced from the Deepr Airdrop address (accruing value from all launches on the platform).

- The Deepr Vault may use collected ETH for ecosystem initiatives, including potential buy-backs/burns of the native Deepr token.

- Deployed with no team allocation for this token; initial supply was held by the contract for the launch mechanism.

Smart Liquidity Design

Best of Both Worlds

💡

Starts with lower liquidity allowing for:

- Lower launch costs

- Faster price appreciation

- More accessible launch requirements

- Quick price discovery

As market cap grows:

- Liquidity automatically scales up

- Price stability increases

- Manipulation becomes harder

- Slippage fees decrease

Result: Early price action of a low-cap gem with the stability of a mature token

Price Impact Protection

(based on $2500 ETH and $144 SOL)

When someone sells 3% of supply:

| Market Cap | Pump.fun | Deepr.fun | Advantage |

|---|---|---|---|

| $100k FDV | 30.0% price drop | 27.5% price drop | 1.1x less impact |

| $500k FDV | 51.6% price drop | 39.5% price drop | 1.3x less impact |

| $2M FDV | 71.5% price drop | 49.8% price drop | 1.4x less impact |

| $5M FDV | 82.3% price drop | 60.4% price drop | 1.4x less impact |

Protected Token Distribution

Initial Supply Protection

- Only 22% of supply is sold in the initial tranche, paired with another 22% of supply as initial liquidity.

- Remaining 56% of supply is controlled by the contract: 28% is locked in 13 progressive tranches, and 28% remains held by the contract for future use or governance.

- Each tranche only unlocks when the market price reaches specific levels defined in the contract.

- Makes it impossible for whales to bundle the entire supply at launch.

- Forces distribution across different price points as the token matures.

Purchase Limits By Tranche

- Initial Tranches (0-2): Max purchase limited to 5% of the tranche supply per wallet.

- Middle Tranches (3-5): Limit increases to 10% per wallet.

- Upper-Middle Tranches (6-8): Limit increases to 20% per wallet.

- Later Tranches (9-13): Limits removed (relative to tranche size).

- Result: Prevents single-entity dominance while allowing larger buys as the market matures.

Fair Distribution Protection

Deepr ensures fair token distribution through carefully designed mechanisms:

Distribution Controls

- Purchase Limits: Per-tranche wallet limits (starting at 5%) prevent large initial accumulation and ensure fairer distribution compared to unprotected launches.

- Progressive Release: The tranche system prevents instant supply concentration and forces distribution over time and price levels.

- Legitimate buyers can still accumulate normally within limits.

- Natural price movement remains possible while excessive concentration is prevented.

The Deepr.fun Advantage

How It Enables Fair Growth

- Supply Protection: Impossible to bundle all tokens at launch

- Equal Access: Every buyer gets the same opportunity at each price level

- No Bot Advantage: Bots can’t front-run or manipulate gas prices

- Natural Momentum: Price can still move quickly when genuine demand exists

- Protected Discovery: Price finds its level through real market activity

Protection Without Restriction

Traditional launches force you to choose between:

- Having entire supply bundled by whales

- Getting sniped by MEV bots

- Having artificial global limits that kill momentum

Deepr.fun solves this by:

- Distributing supply across price levels (Tranches)

- Ensuring fair distribution (Purchase Limits)

- Implementing wallet limits per tranche (fair access)

- Allowing natural price discovery

- Enabling legitimate accumulation

- Supporting organic growth patterns

The Result

A token launch mechanism designed for fair participation and sustainable growth, directly addressing common pitfalls:

- Initial supply cannot be bundled at launch (Tranche 0 + LP).

- Excessive concentration is prevented (Purchase limits ensuring wider initial distribution).

- Price discovers its level through genuine demand across tranches.

- Fair distribution is maintained throughout the launch process.

- Liquidity scales naturally with market cap growth, enhancing stability.

Last updated on